3. Decades of Financial Paperwork and Redundant Documents

The filing cabinet was once the command center of the household, but in the digital age, it can become a museum of obsolete paper. Years of accumulated bank statements, utility bills, credit card offers, and appliance warranties can create a formidable mountain of paper. This isn’t just clutter; it’s a potential fire hazard and a source of stress, especially when considering estate planning and making things simpler for your loved ones.

The key to tackling this is knowing what you must keep and what you can safely destroy. Not all paper is created equal. Certain documents are essential and should be kept in a secure, fireproof location. These include birth certificates, Social Security cards, marriage licenses, passports, property deeds, vehicle titles, will and trust documents, and power of attorney forms.

A Guideline for Shredding

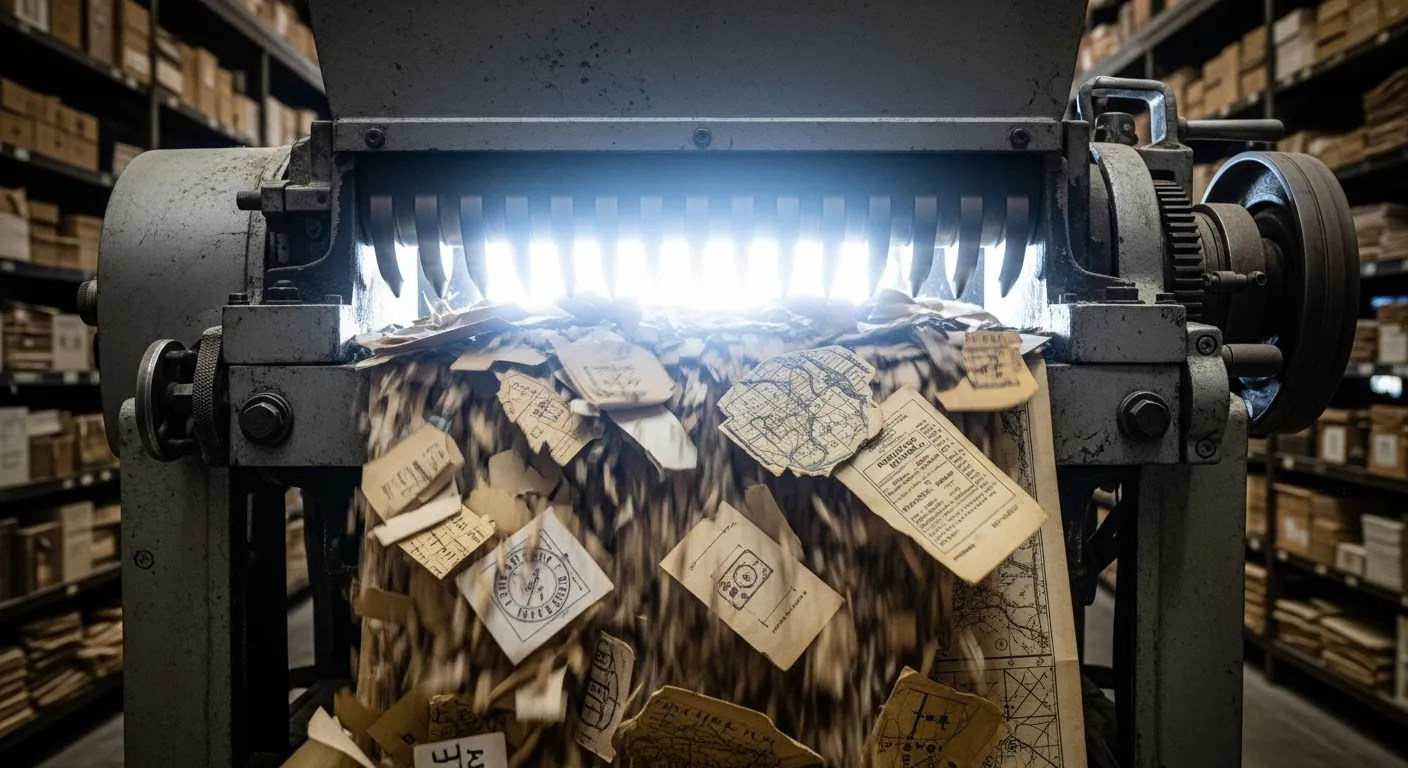

For most other documents, a clear timeline applies. Tax records are a big one. The general rule is to keep them for at least three years, but some financial advisors suggest seven years, just to be safe. After that period, you can shred them. What about bank and credit card statements? If you don’t need them for tax purposes, you can often shred them after a month or two, once you’ve reconciled them. Most of this information is available online anyway.

Pay stubs can be shredded after you’ve checked them against your annual W-2 form. Old utility bills? Once you’ve paid them and confirmed the payment was received, you rarely need the paper copy. The same goes for ATM receipts and credit card slips. Expired warranties for items you might not even own anymore are prime candidates for the shredder.

The most important tool in this process is a cross-cut shredder. Simply tossing documents with personal information into the recycling bin can make you a target for identity theft. Take the time to properly destroy anything with your name, address, or account numbers on it. For large volumes, a local shredding service can be a worthwhile investment. Simplifying your paperwork is a profound gift to both your future self and your family, making your financial life transparent and manageable.